Colorado Estimated Tax Form 2025

Colorado Estimated Tax Form 2025. This tax return and refund estimator is for tax year 2025 and currently based on 2024/2025 tax year tax tables. You must send payment for taxes in colorado for the fiscal year 2024 by april 15, 2025.

Calculating and paying colorado estimated taxes. Calculate your annual salary after tax using the online colorado tax calculator, updated with the 2024 income tax rates in colorado.

These Forms Allow Taxpayers To Calculate And Report How Much Income Tax Has Already Been Paid To The State Of Colorado Through Withholding And Estimated Payments And.

The biggest changes are the creation of a new family affordability tax credit and the expansion of the earned income tax credit, both of which were signed into law.

Select The Tax Year You Are Filing For To Be Directed To The Forms For That Year.

(opens in new window) form.

Colorado Estimated Tax Form 2025 Images References :

Source: www.zrivo.com

Source: www.zrivo.com

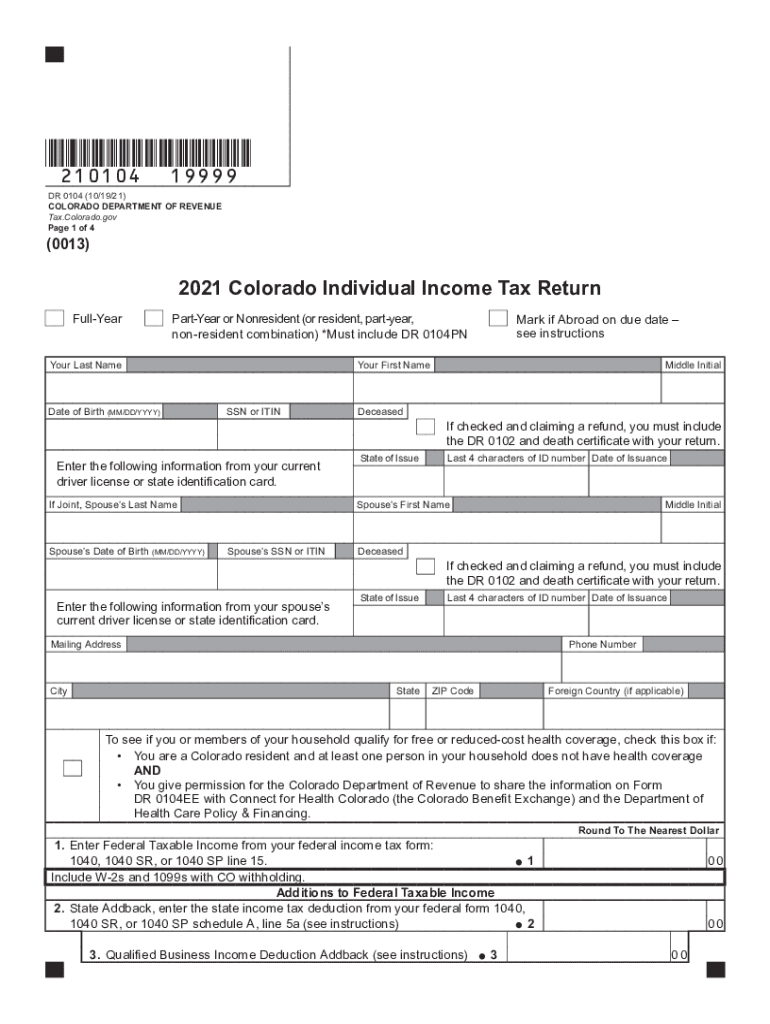

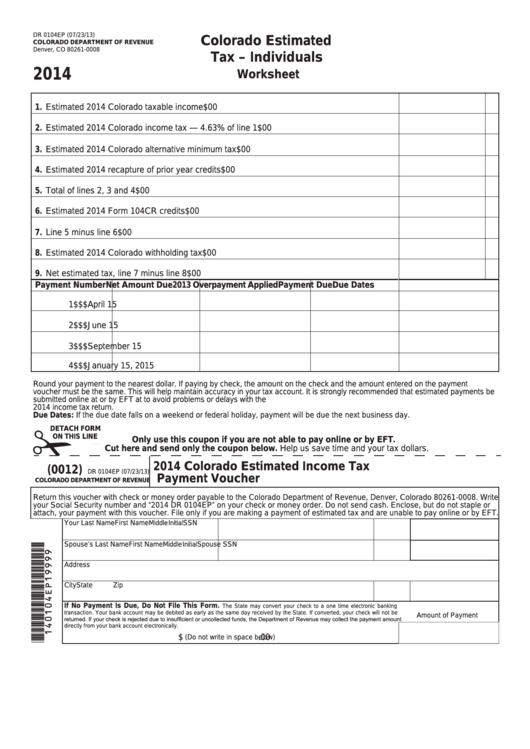

Colorado Estimated Tax Payment Form DR 0104EP, We will update this page for tax year 2025 as the forms, schedules, and instructions become available. These forms allow taxpayers to calculate and report how much income tax has already been paid to the state of colorado through withholding and estimated payments and.

Source: printableformsfree.com

Source: printableformsfree.com

2023 Colorado Estimated Tax Payment Form Printable Forms Free, If a fiduciary wants to pay estimated tax, payments must be submitted with the estimated tax voucher, form dr 0105ep. Use our income tax calculator to find out what your take home pay will be in colorado for the tax year.

Source: www.templateroller.com

Source: www.templateroller.com

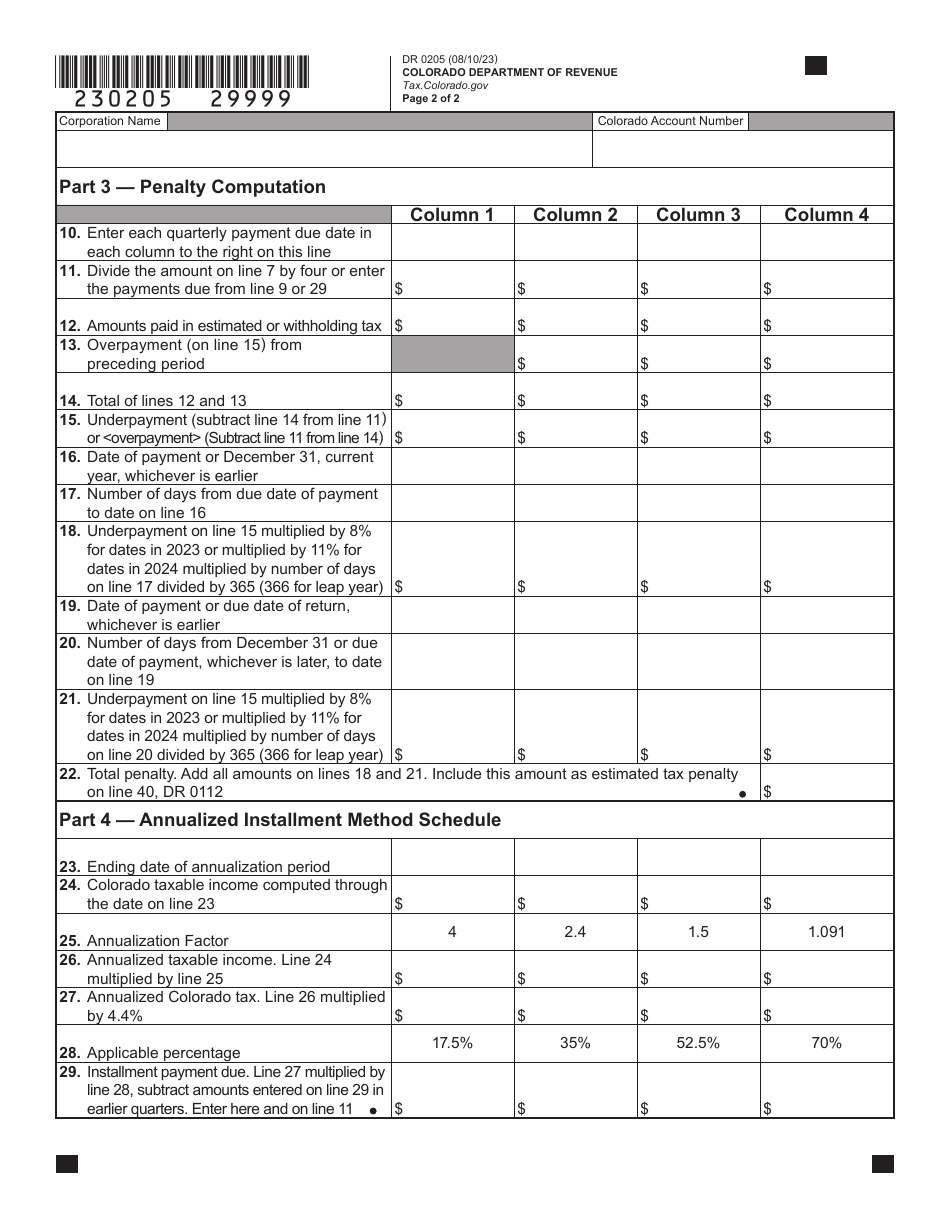

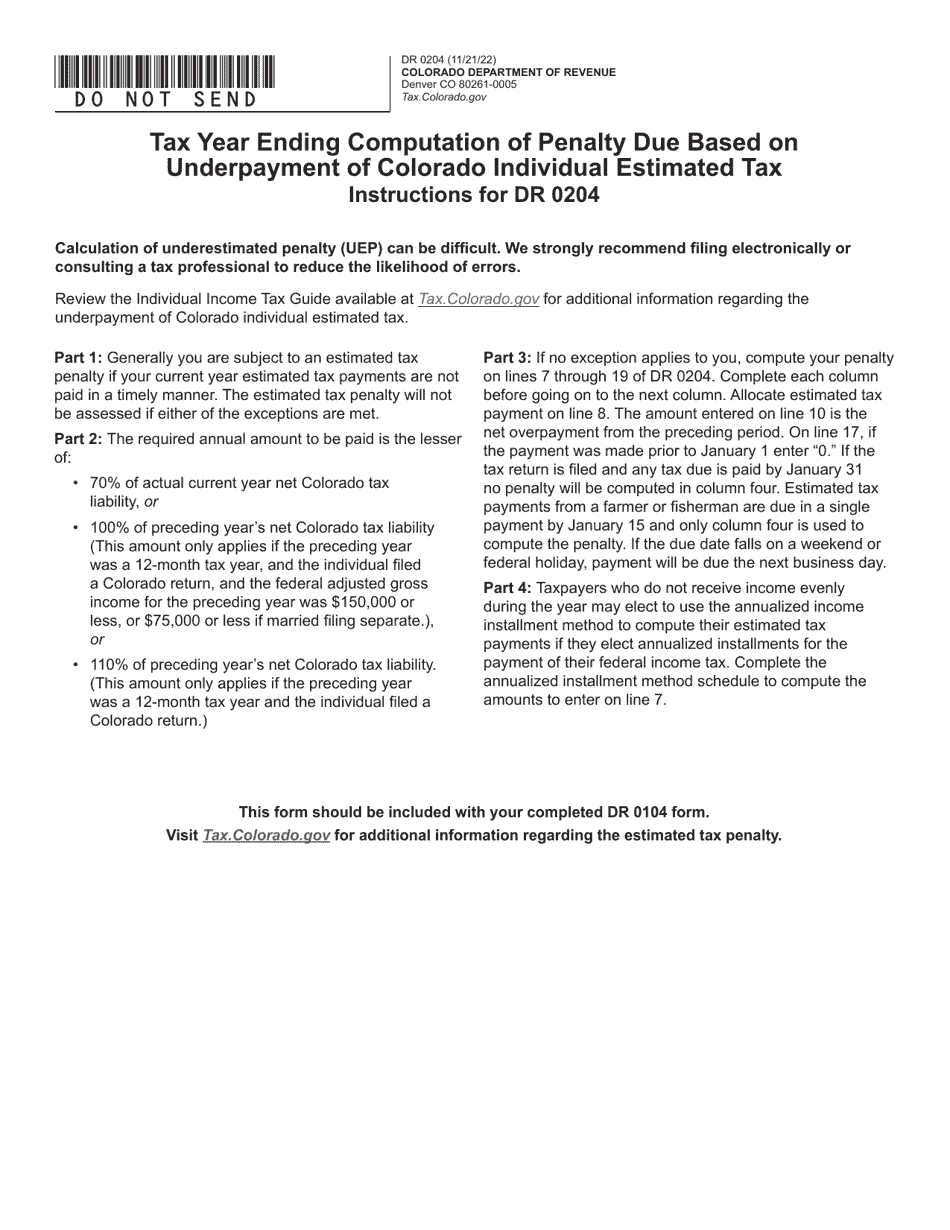

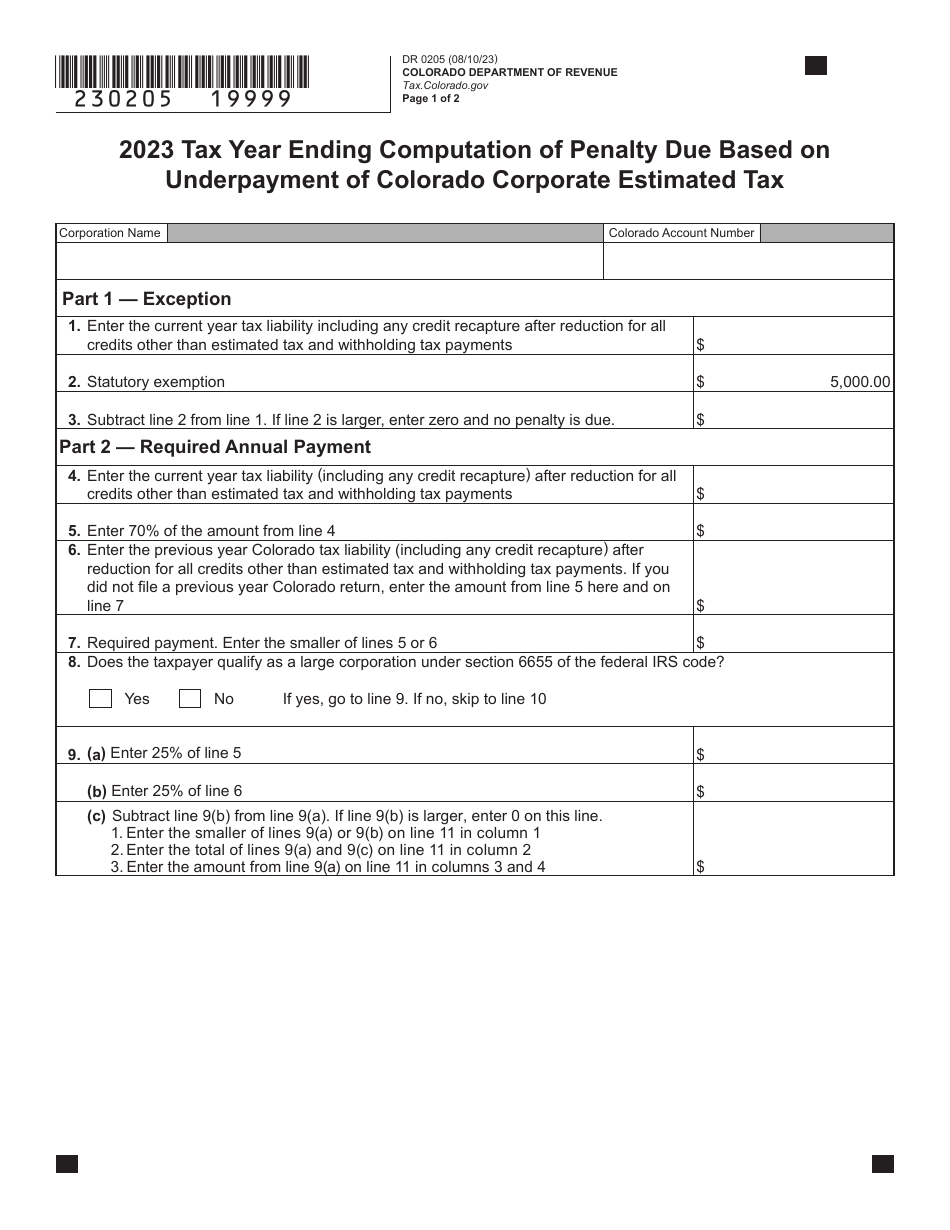

Form DR0205 Download Fillable PDF or Fill Online Tax Year Ending, Calculate your annual salary after tax using the online colorado tax calculator, updated with the 2024 income tax rates in colorado. For instructions on how to compute estimated income tax, see the worksheet provided on the dr 0104ep.

Source: www.templateroller.com

Source: www.templateroller.com

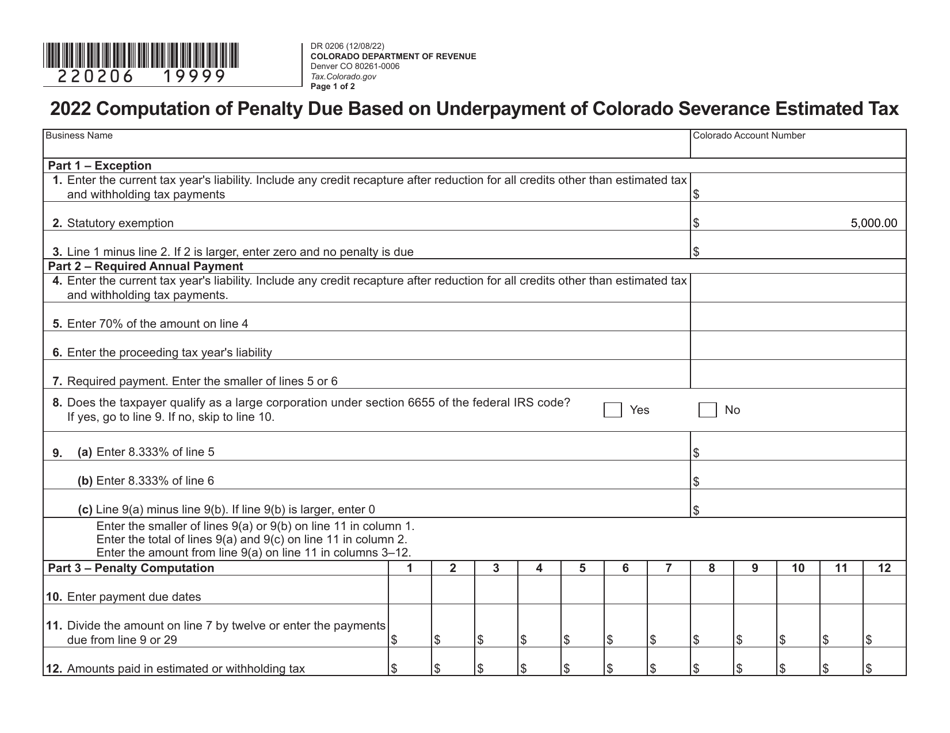

Form DR0206 Download Fillable PDF or Fill Online Computation of Penalty, 2025 tax returns are expected to be due in april 2026. Calculating your cdctc credit can seem complicated.

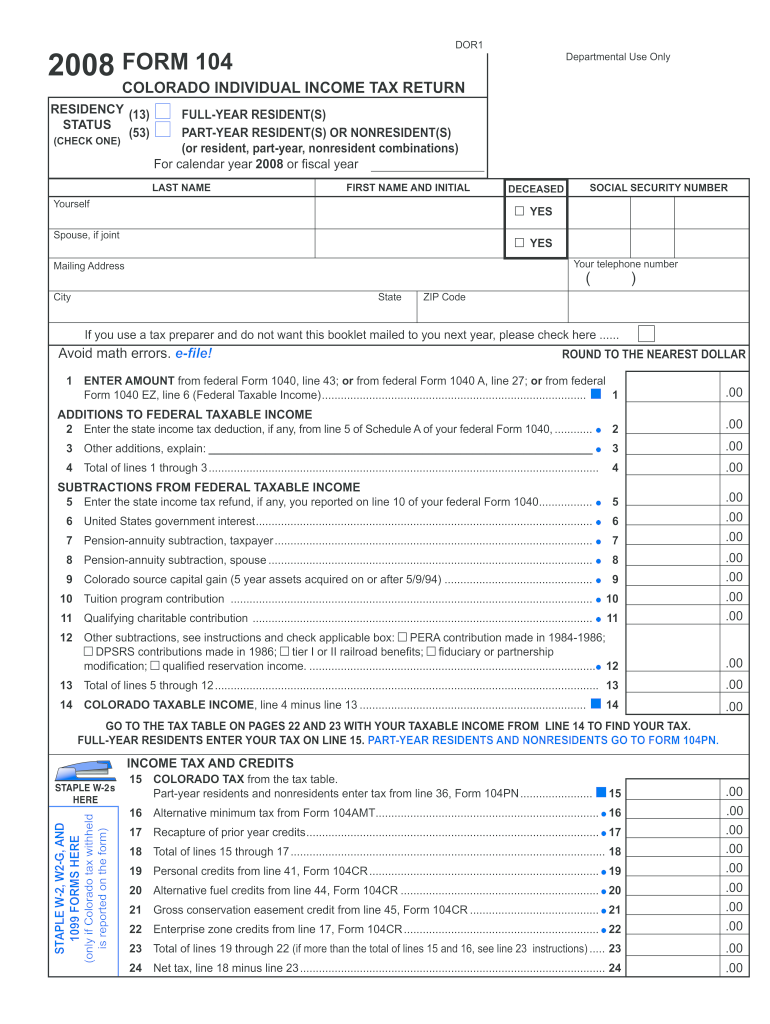

Source: www.signnow.com

Source: www.signnow.com

Colorado State Tax Complete with ease airSlate SignNow, We will update this page for tax year 2025 as the forms, schedules, and instructions become available. Our income tax calculator calculates your federal, state and local taxes based on several key inputs:

Source: www.formsbank.com

Source: www.formsbank.com

Fillable Form Dr 0104ep Colorado Estimated Tax Individuals, These forms allow taxpayers to calculate and report how much income tax has already been paid to the state of colorado through withholding and estimated payments and. As soon as new 2025 relevant tax year data has been.

Source: www.formsbank.com

Source: www.formsbank.com

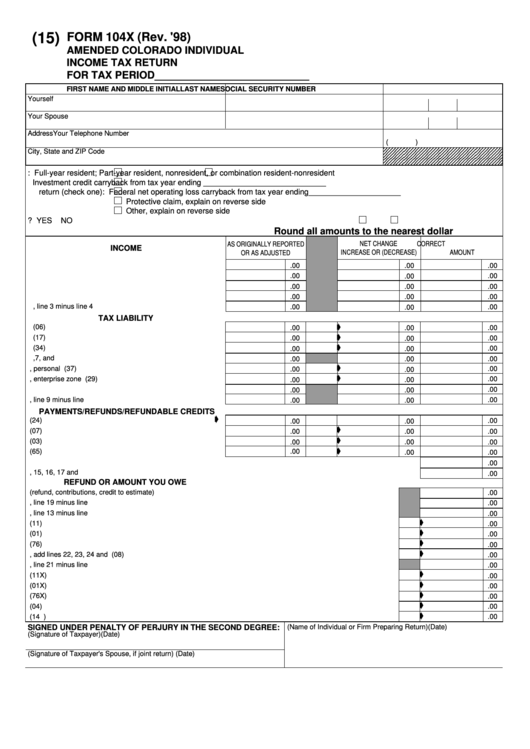

Fillable Form 104x Amended Colorado Individual Tax Return, The election can also be made with an estimated payment by checking the appropriate box on the estimated tax payment form (dr 0106ep). Calculate your annual salary after tax using the online colorado tax calculator, updated with the 2024 income tax rates in colorado.

Source: www.templateroller.com

Source: www.templateroller.com

Form DR0204 Download Fillable PDF or Fill Online Tax Year Ending, Estimated tax is the method used to pay tax on income that is not subject to withholding. (opens in new window) form.

Source: glynisqnorrie.pages.dev

Source: glynisqnorrie.pages.dev

Colorado Estimated Tax Form 2024 Carla Cosette, 2025 tax returns are expected to be due in april 2026. You can quickly estimate your colorado state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to.

Source: www.templateroller.com

Source: www.templateroller.com

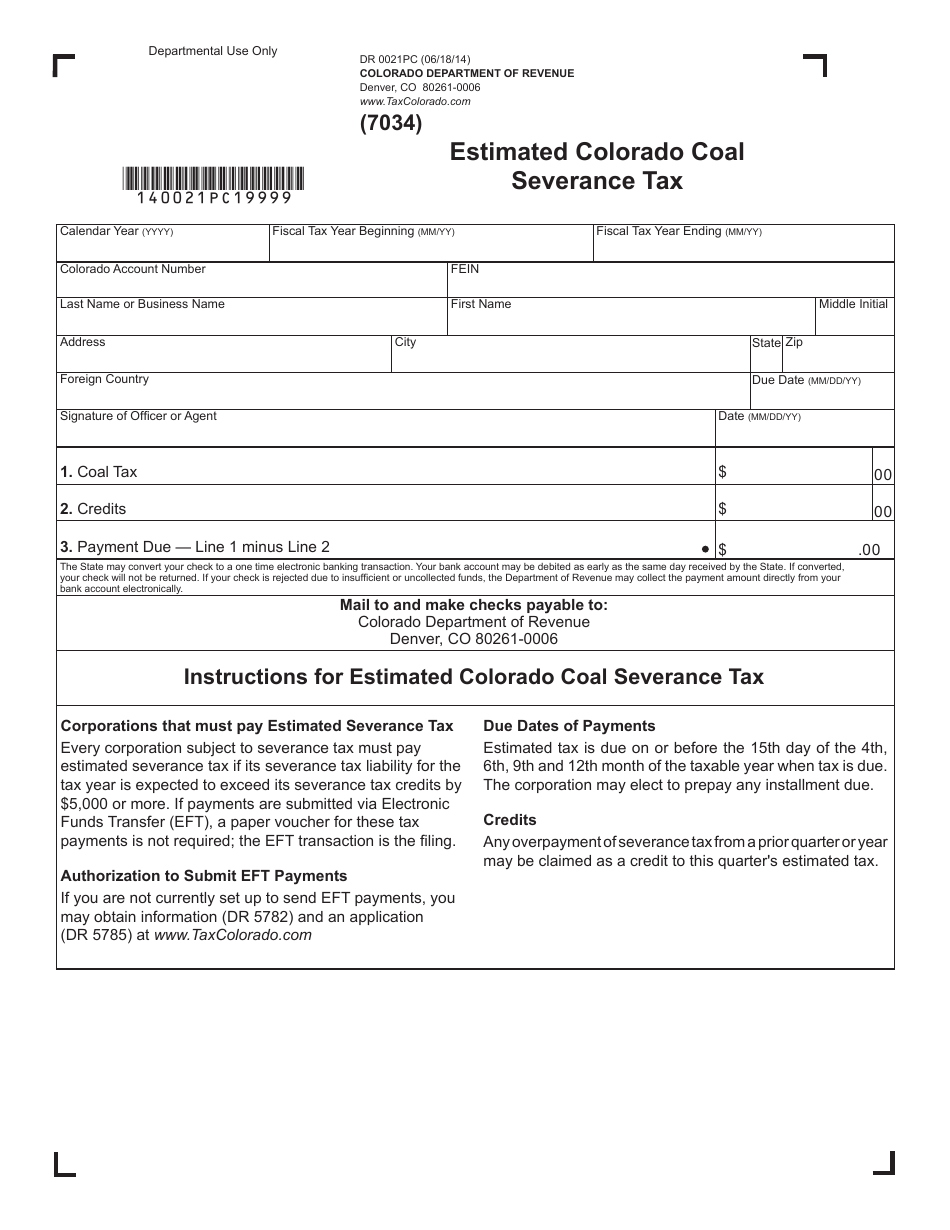

Form DR0205 Download Fillable PDF or Fill Online Tax Year Ending, The election can also be made with an estimated payment by checking the appropriate box on the estimated tax payment form (dr 0106ep). Get ahead colorado recommends three free tax filing resources that make claiming the cdctc easy by calculating your.

Our Income Tax Calculator Calculates Your Federal, State And Local Taxes Based On Several Key Inputs:

You must send payment for taxes in colorado for the fiscal year 2024 by april 15, 2025.

If The Ptes State Tax Liability Exceeds $5,000 Per Year, It Must Pay Quarterly Estimated Taxes Beginning April 15, 2023.

2025 tax returns are expected to be due in april 2026.

Category: 2025